Earlier this year we were asking a question across the nonprofit community: is wealth screening dead? As we explored the new face of modern fundraising, we were asking ourselves where wealth screening fits into the equation. Whether it still has a place in fundraisers’ tool boxes.

And we’re back with an update: wealth screening isn’t dead. It’s a critical part of the donor data process that is the foundation of many donor research practices today. However, there’s an important caveat: It’s not enough on its own.

A brief history of wealth screening

Wealth screening has been used for decades to research donors and prospective donors. A standard tool in the toolboxes of nonprofits, higher ed advancement teams and healthcare institutions for decades, wealth screenings help organizations figure out which potential donors can afford to support their cause.

The evolution of wealth screening

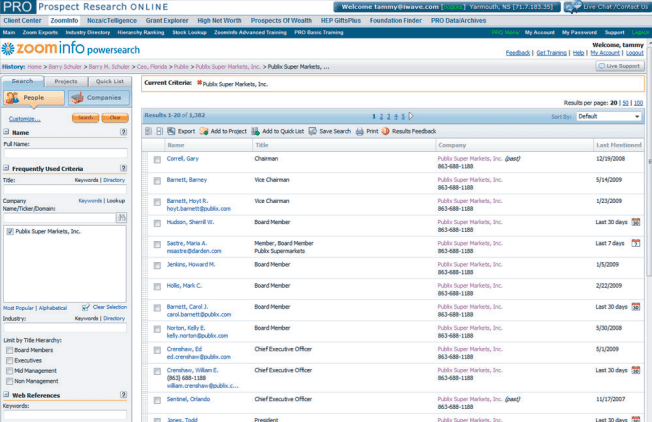

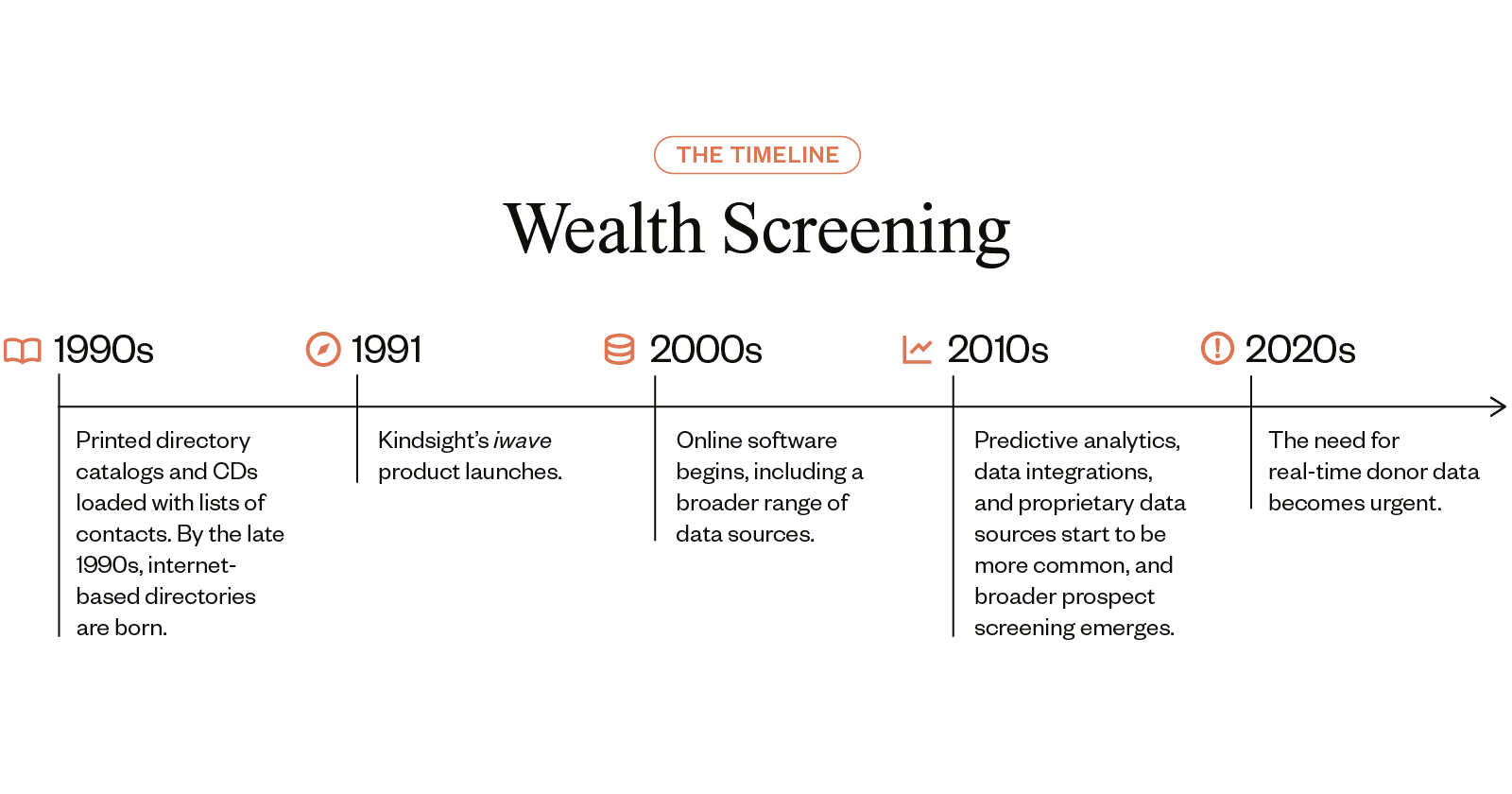

In the 1990s, wealth screening consisted of printed directory catalogs and CDs loaded with lists of contacts. But by the late 1990s, it was already evolving to more accessible, internet-based directories. By the 2000s, online software providers began including a broader range of data sources and just a decade later more sophisticated predictive analytics, data integrations, and proprietary data sources are becoming more common. By this time, a deeper understanding of data led to the inclusion of more than just wealth when researching, specifically affinity and propensity – and the term prospect screening gained traction.

Kindsight’s iwave product launched in 1991 and has continued to evolve ever since, staying at the cutting edge of each of these early wealth screening transformations. And by the 2020s, we saw donors not just allowing, but expecting nonprofits to have a full picture of their lives and to know about various changes they experience as they happen – so the urgent need for real-time data became a non-negotiable.

The challenges of traditional wealth screening

Nonprofits – and the technology serving them – are continuing to adapt and change as they navigate disruptions. Everything from dollars up, donors down to shrinking fundraising teams and a surplus of data is impacting the way we interact with donors.

Fundraisers know that the best approach is a personalized, meaningful, and human-centered one. They know that they need to connect their organization’s story to their donor’s story. Wealth screening has traditionally been used to inform that storytelling and foster that meaningful connection – but over time, this tool has become less effective.

First, the process of manually uploading large groups of prospects or donors into your database can be time consuming. Second, the main focus of wealth screening is on wealth (hence the name), leaving out other factors that seriously impact the likelihood of someone becoming a donor. But perhaps most importantly, the information is at risk of becoming out of date.

Nonprofit organizations face challenges in advancing their mission as staff are overwhelmed by manual data updates and incomplete donor insights. With donor retention rates falling to just 42.6%, nonprofits are left with a shrinking pool of reliable supporters. Other hidden costs of stale data include:

- Missed Opportunities: Fundraising gaps remain unnoticed due to stale donor data and poor data visibility.

- Inefficient Outreach: Engagement drops as nonprofits fail to connect with the right donors at the right time.

- Wasted Resources: Time and money are lost targeting unqualified prospects.

Traditional wealth screening isn’t bad, it just gives an incomplete picture if it only focuses on capacity, leaving affinity and propensity out of the story. Imagine a child going through a growth spurt over the course of a year. Each day, something is slightly different, they get a bit bigger. What if you only bought them clothes once a year? The clothes from January would not fit properly in August. Imagine further if you only looked at their height, and not their shoe size. This is what it is like when you only look at the wealth capacity of a donor; you are missing so much of the broader picture. Their affinities and propensity to give are as integral as wealth to the execution of the stewardship process.

Traditional wealth screening is also limited to individuals, which is a real problem considering more foundations and companies are in existence (and giving to nonprofits) than ever. According to Giving USA’s Annual Report on Philanthropy, giving by foundations grew 1.7 percent in 2023, and giving by corporations is estimated to have increased by 3.0 percent in 2023. This shift in giving trends means it is imperative to have access to and understand your foundation and corporate prospects.

In other words, wealth screening is static, and results are a point-in-time snapshot. All the while, donors now expect organizations to understand them and their situation on a deep level. Our online algorithms are serving us exactly what we want on a daily basis, and we expect the same from nonprofits. Donors expect personalized, timely engagement. What happens when you miss a key life event of a donor you are stewarding? This can easily lead to inauthentic connections and missed opportunities.

Updating the fundraiser’s tool box with real-time data

In a world that has evolved so much technologically, we now have the power to harness vast amounts of data, dig deeper into individuals, and understand the motivations behind why they give – all in real time. Thanks to today’s technology, we can now move beyond traditional wealth screening with tools like Kindsight’s live profiles, a donor intelligence solution for nonprofit organizations who struggle with outdated donor data and inefficient outreach. Live profiles continuously tracks donor data, automatically surfacing critical changes, like real estate transactions, new donations, and insider filings, enabling fundraising teams to make timely, informed decisions and personalize donor engagement.

Unlike competitors offering static donor snapshots, live profiles uniquely monitors donor profiles continuously, delivering real-time updates that enable nonprofits to act on fresh opportunities with confidence and precision.

How wealth screening and live profiles work together to fuel fundraising

Combining wealth screening and live profiles together makes for a powerful approach to fundraising. Wealth screenings provide additional data about board affiliations and connections, plus they combine first- and third-party data to update deeper analytics (RFM, Insights) that are not captured in the real-time updates of third-party data alone.

When wealth screening and live profiles are used together, the heavy lifting is done by Kindsight, giving nonprofits access to the most current, comprehensive, and actionable donor profiles. This empowers them to engage donors with precision and confidence at exactly the right moment:

Optimize Fundraising Revenue: Tailor asks to donors’ current capacity for larger gifts.

Build Stronger Relationships: Enhance engagement with hyper-personalized outreach.

Boost Operational Efficiency: Automate updates to free staff for mission-critical tasks.

Drive Campaign Success: Leverage real-time insights to minimize waste and accelerate results.

—

Over 90% of the world’s data was created in the last two years. As more and more donor data becomes available, the biggest challenge facing fundraisers will quickly become stale and static data. And as a result, the longstanding tools that fundraisers have used will need to be supplemented with additional technology that modernizes their approach to data – and supports their quest to make meaningful connections, at any scale.

Be the first to read our resources.

The world is changing quickly—and our resources help you stay on top of it all. Sign up to get new insights, success stories, and more, sent right to your inbox.