Wealth screening gives nonprofits the insights they need to identify high-potential supporters and make data-driven fundraising decisions. Understanding your donors is key to successful fundraising. This guide explores how wealth screening strengthens fundraising strategies and maximizes donor impact.

What is wealth screening?

Wealth screening for nonprofits is the process of using public and third-party data to identify individuals with the financial capacity to make significant contributions. It helps nonprofits quickly determine which current and prospective donors are most likely to support major gift fundraising.

The wealth screening process involves uploading donor data from your fundraising CRM (constituent relationship management system) into wealth screening software. That software analyzes public records and other wealth indicators, including income signals, real estate ownership, and stock holdings, to estimate each donor’s giving capacity.

Wealth screening helps your team prioritize outreach and set ask amounts based on donors’ financial capacity. When used alongside prospect research software, you gain additional insights into donor interests, giving history, and motivations, providing a more complete view.

Types of wealth screening data nonprofits use

Wealth screening uses multiple data types to evaluate a donor’s financial capacity and potential for significant contributions. These insights help prioritize prospects for fundraising outreach.

- Wealth indicators: Financial assets such as real estate holdings, stock holdings, business affiliations, and other assets pulled from public records and government databases.

- Biographic and demographic data: Basic personal information used to confirm identity and accurately match donor records.

Note: For insights on donor giving history, engagement, and affinity, combine wealth screening with prospect research and your internal donor database.

Benefits of wealth screening for nonprofits

Wealth screening helps nonprofits identify high-value donors, set realistic fundraising goals, and focus resources where they drive the most impact.

Below are six key benefits of using wealth screening in your nonprofit.

1. Identify major donors

Wealth screening software helps identify major donors with the financial capacity to make significant gifts. By prioritizing high-capacity prospects, your team can focus outreach where it’s most likely to succeed.

Research shows major donors who give more than $5,000 have a higher repeat-gift rate (about 37.75 percent) than donors in smaller giving tiers. Similarly, many planned giving donors maintain or increase their annual giving after establishing a planned giving commitment, highlighting the value of targeting financially capable supporters.

2. Determine matching gift eligibility

Some wealth screening software includes employment and company data that will identify donors whose employers offer matching gift programs. These programs often double or triple donations, but are frequently overlooked due to low donor awareness.

By combining wealth screening insights with employer information, nonprofits are able to flag supporters who qualify for matching gifts. This allows teams to increase total revenue without increasing donor out-of-pocket contributions.

3. Understand potential donors faster

Wealth screening software provides a clear snapshot of donor capacity to give in a short timeframe. It replaces weeks of tedious manual research with centralized, organized data pulled from multiple public sources. This efficiency allows fundraising teams to spend less time gathering financial information and more time planning outreach to high-capacity prospects.

4. Support stronger fundraising goals

Wealth screening helps nonprofits set realistic fundraising goals by estimating the financial capacity of donors. It gives insight into how much your donor base may be able to give across segments, including major and mid-level prospects. With this information, campaigns, budgets, and timelines are able to be aligned with achievable targets, keeping fundraising efforts focused and organized.

5. Tailor donor asks based on capacity

Wealth screening helps set realistic ask amounts by identifying a donor’s financial capacity. Using these capacity insights ensures solicitation amounts align with what a donor is reasonably able to give, supporting more effective and appropriate fundraising outreach.

6. Increase donor contribution amounts

Wealth screening identifies annual donors with the financial capacity to increase their gifts. Prioritizing outreach based on capacity grows gift sizes and builds long-term donor value without risking donor trust.

Wealth screening vs prospect research

Wealth screening assesses a donor’s financial capacity using wealth and financial indicators. It identifies which existing donors and prospects have the ability to make significant contributions.

Prospect research is a broader process that evaluates donors using capacity, philanthropic indicators, affinity indicators, and giving behavior. It provides deeper insight into donor interests, motivations, and likelihood to give.

Wealth screening is often the first step within the prospect research process. Used together, both approaches give nonprofits a more complete view of major donor prospects.

Steps in the wealth screening process

Wealth screening turns donor data into clear, usable fundraising insights through a series of steps. It combines external wealth indicators with your internal donor records to prioritize prospects.

A complete wealth screening uses these data sources:

- Prospect list: The individuals your nonprofit wants to evaluate

- Internal donor data (optional): Your organization’s giving records and donor insights you have gathered

- External data: Public records and provider-supplied wealth indicators

The primary factor evaluated by wealth screening is:

- Capacity: Does the donor have the financial means to give?

Insight: For insights on donor interest or giving behavior, combine wealth screening with prospect research and internal engagement data.

The following steps keep the wealth screening process accurate, actionable, and aligned with your fundraising goals.

Step 1: Determine your goals

Start by defining what you want from the wealth screening. Clear goals will guide who you screen and how you use the results.

Key questions to answer:

- What information do we need from this screen?

- How will we measure success?

- Which donors or prospects should we segment?

- Are we screening based on budget limits, expected volume, a specific constituency, or the full database?

- Who will review and act on the results?

- Do they have the time and resources for analysis, verification, rating, and coding, or do they need additional support?

Step 2: Clean up and segment your database

Wealth screening results are only as good as your data. Errors like misspelled names, outdated information, and empty fields reduce accuracy and limit insight.

Before screening:

- Merge duplicate records.

- Update outdated contact and donor information.

- Remove or refresh data that is more than two years old.

- Optionally, clean up internal donor information (gift dates, amounts, frequency, and relationship notes) to use alongside screening results.

If screening the full database isn’t realistic, prioritize high-value groups you’re able to identify before screening, such as:

- Current major donors

- Mid-level donors based on past giving tiers

- Lapsed major donors

- Recurring or loyal donors with consistent giving

- New prospects added through recent outreach campaigns

Step 3: Prepare the template

Most wealth screening tools use an upload template, often an Excel file. You would typically choose from:

- A standard template provided by the provider

- A custom template tailored to your data and screening goals

Accurate formatting ensures smooth uploads and reliable screening results.

Step 4: Customize screening parameters

Customize key settings so the screening reflects your nonprofit’s fundraising priorities.

Key adjustments include:

- Define major gift levels: Set what qualifies as a major gift for your organization.

- Adjust confidence of match (COM): Higher confidence reduces false positives but returns fewer results.

- Set capacity weighting: Define how much capacity is your priority versus other factors, such as affinity and propensity.

- Select your preferred affinity: Choose from a list of affinity categories such as Education, Healthcare, Arts and Culture, and many more (if available in your tool’s settings) to find donors who are already connected with your cause.

Step 5: Run a trial screen

Test the process before screening your full list. A small trial helps validate settings and data quality.

Include a mix of donors and prospects, such as:

- 20 well-known donors

- 20 partially known contacts

- 20 prospects representing different donor types

Use the results to confirm accuracy and alignment with your goals.

Step 6: Submit the file

Once all settings are finalized, upload the full file to the screening provider. Results will be returned in minutes or several weeks, depending on the screening tool and the size of your data. Completing this step finalizes the wealth screening process and equips your nonprofit with insights for informed fundraising decisions going forward.

Elevate your fundraising game

Our Wealth Screening Playbook gives you advanced strategies to identify ideal donors, leverage real-time data, and customize your approach for maximum impact.

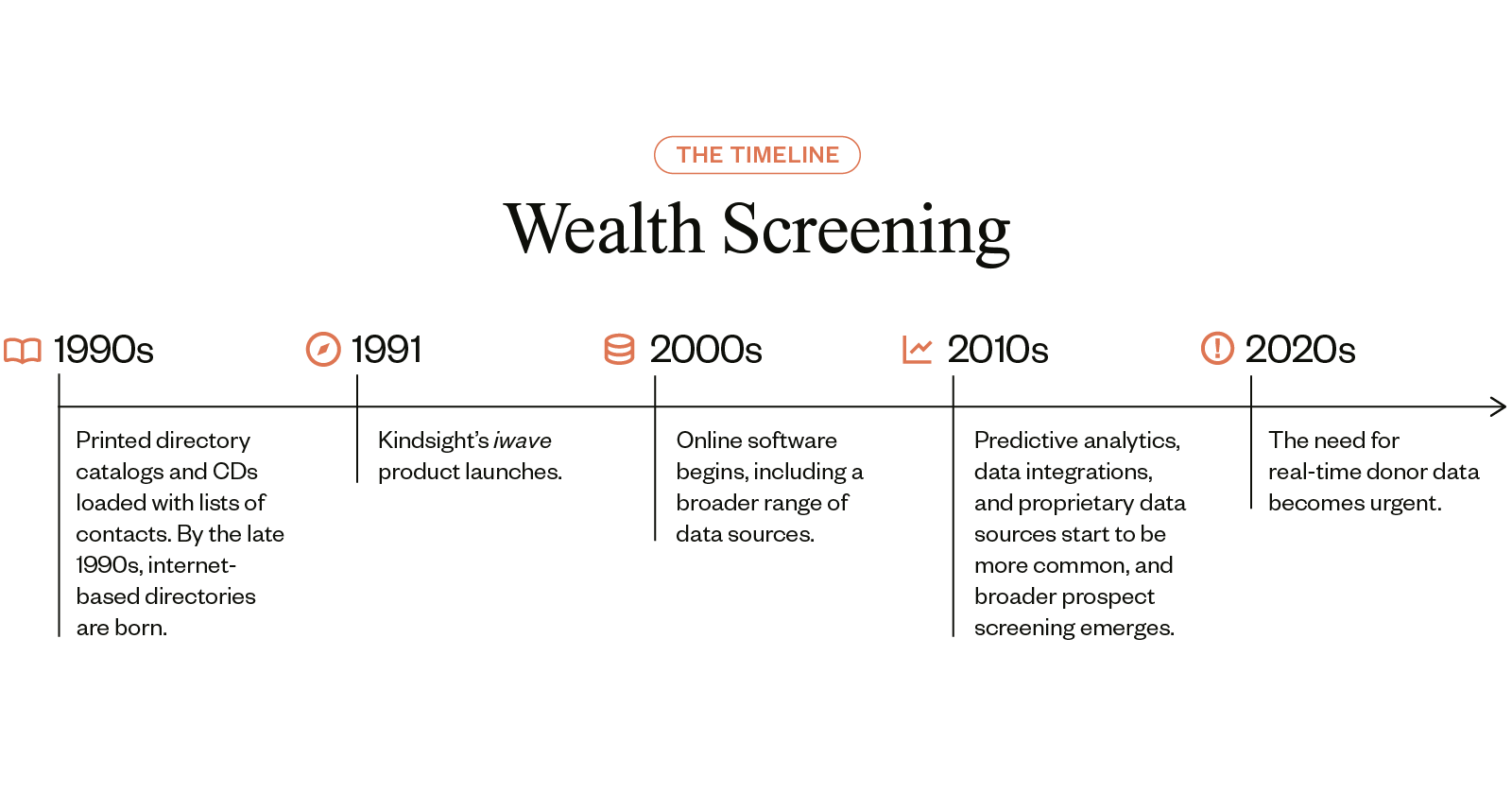

History of wealth screening

Wealth screening has been used for decades by nonprofits, higher ed advancement teams, and healthcare institutions to research donors and prospective donors.

The evolution of wealth screening

- 1990s: Wealth screening consisted of printed directory catalogs and CDs loaded with lists of contacts.

- Late 1990s: Wealth screening was already evolving to more accessible, internet-based directories.

- 2000s: Online software providers began including a broader range of data sources.

- 2010s: Online providers added more sophisticated predictive analytics, data integrations, and proprietary data sources. By this time, a deeper understanding of data led to the inclusion of more than just wealth when researching (specifically affinity and propensity). The term “prospect screening” gained traction.

iWave launched in 1991 and has continued to evolve ever since. Through all the industry changes, we have stayed at the cutting edge of each of these wealth screening transformations. By the 2020s, we saw donors not just allowing, but expecting nonprofits to have a full picture of their lives and to know about various changes they experience as they happen. The urgent need for real-time data became a non-negotiable.

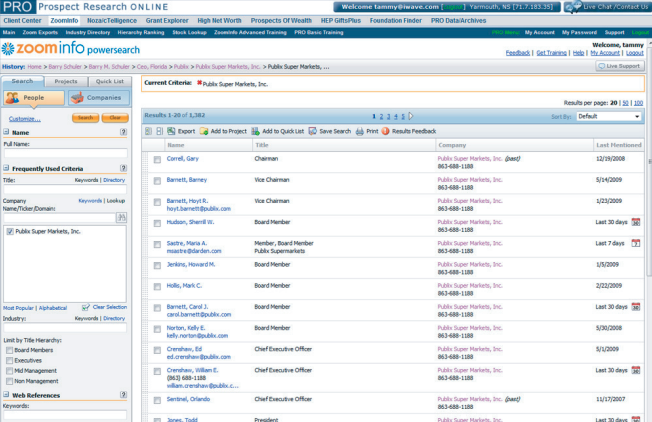

iWave’s prospect research software circa 2009-2010

How to use wealth screening data for fundraising

To get the most out of your wealth screening investment, your nonprofit must turn screening results into clear, actionable fundraising decisions. Use wealth screening results to:

- Identify potential major donors: Find individuals with the capacity to make larger gifts.

- Estimate giving capacity: Use wealth indicators to set realistic ask amounts.

- Segment your donor base: Group donors by capacity for targeted outreach.

- Prioritize outreach efforts: Focus time and resources on prospects with the highest giving potential.

Challenges of traditional wealth screening

Wealth screening is a powerful fundraising tool, but static, one-time data has limitations. It provides only a snapshot of donor capacity, which quickly becomes outdated as finances, priorities, or circumstances change.

Hidden costs of stale data include:

- Missed opportunities: Fundraising gaps remain unnoticed due to stale donor data and poor data visibility.

- Inefficient outreach: Engagement drops as nonprofits fail to connect with the right donors at the right time.

- Wasted resources: Time and money are lost targeting unqualified prospects.

Traditional wealth screening isn’t bad. It just gives an incomplete picture if it only focuses on capacity, leaving affinity and propensity out of the story. Imagine a child going through a growth spurt over the course of a year. Each day, something is slightly different as they get a bit bigger. What if you only bought them clothes once a year? The clothes from January would not fit properly in August. Imagine further if you only looked at their height, and not their shoe size.

This is what it is like when you only look at the wealth capacity of a donor; you are missing so much of the broader picture. Their affinities and propensity to give are as integral as wealth to the execution of the stewardship process.

Traditional wealth screening is also limited to individuals, which is a real problem considering that more foundations and companies exist and are giving to nonprofits.

According to Giving USA’s Annual Report on Philanthropy, giving by foundations grew 2.4 percent in 2024, and giving by corporations is estimated to have increased by 9.1 percent in the same year. This shift in giving trends means it is imperative to have access to and understand your foundation and corporate prospects.

To maximize effectiveness, nonprofits should view wealth screening as one piece of a broader, data-driven fundraising strategy. Combining wealth screening with internal donor data, prospect research (including companies and foundations), and real-time live profiles creates a complete, up-to-date view of donors.

Live profiles continuously track donor data, automatically surfacing critical changes like real estate transactions, new donations, and insider filings. This saves time updating information manually, strengthens relationships, and empowers fundraisers to engage donors with a tailored (often larger) ask at exactly the right moment.

An integrated approach turns limitations into opportunities for smarter, more informed outreach and stronger donor engagement.

Wealth screening best practices

Use these best practices to improve accuracy and results from wealth screening:

- Verify top prospects: Manually review high-value prospects to confirm accuracy before outreach.

- Layer internal data: Combine external wealth scores with your CRM giving history to identify loyal, high-capacity donors.

- Protect donor privacy: Follow current data protection and compliance standards throughout the screening process.

- Refresh screening regularly: Re-screen your database every 12–18 months to capture changes in financial capacity.

See our wealth screening cheat sheet for more best practices and tips.

Top wealth screening tools

Choosing the right platform depends on your fundraising goals, data needs, and team workflows. Here are some widely used and well-established wealth screening tools.

- iWave:Our leading wealth intelligence tool for nonprofits. iWave combines wealth, philanthropic, business, and relationship indicators into a single profile. Customizable capacity scoring supports accurate major gift identification.

- DonorSearch: Offers a database of historical gift tracking to validate donor capacity and confirm past giving patterns.

- WealthEngine: Uses consumer data and lifestyle insights to help nonprofits build donor segments based on financial capacity and demographic data.

- WindFall: Specializes in household-level wealth and financial behavior data, with a focus on identifying high-net-worth individuals. It helps identify affluent prospects based on modeled net worth and financial triggers.

Harness the power of wealth screening

Wealth screening for nonprofits transforms donor data into actionable fundraising insights by identifying high-potential supporters and estimating their giving capacity. It helps nonprofits prioritize outreach and make data-driven fundraising decisions.

Over 90% of the world’s data was created in the last two years. As more and more donor data becomes available, the biggest challenge facing fundraisers will quickly become stale and static data.

The longstanding tools that fundraisers have used will need to be supplemented with additional technology that modernizes their approach to data and supports their quest to make meaningful connections, at any scale.

When combined with prospect research, internal donor data, and real-time live profiles, wealth screening becomes part of a broader, integrated strategy. This approach maximizes donor engagement, increases contributions, and supports long-term fundraising success.

Be the first to read our resources.

The world is changing quickly—and our resources help you stay on top of it all. Sign up to get new insights, success stories, and more, sent right to your inbox.