Planned gifts are any charitable contributions that are arranged in advance, often as part of a donor’s estate or financial plans. Planned giving offers donors a strategic way to support the causes and organizations they care about, often establishing a philanthropic legacy that lasts beyond their lifetime.

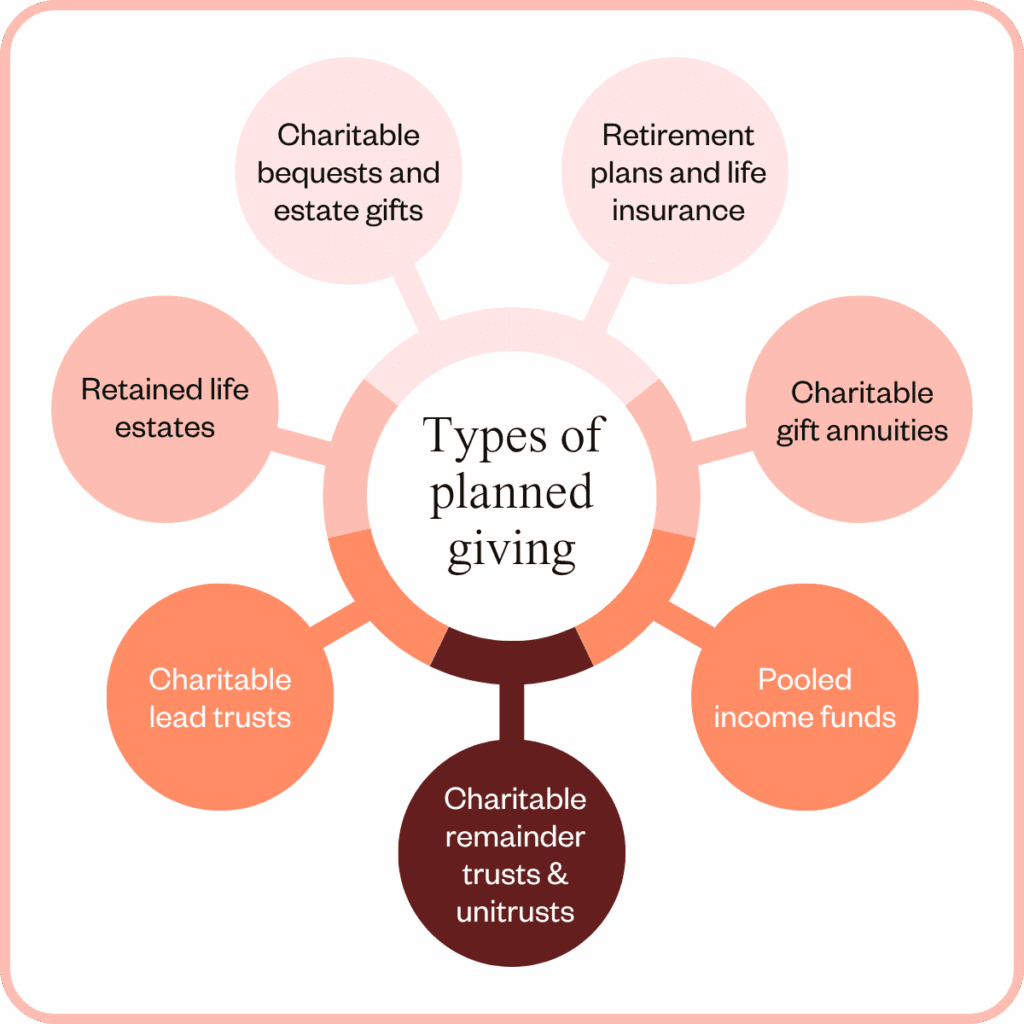

There are many types of planned giving, each with its own unique structure, timing, and regulations. In many cases, planned gifts are deferred; the allocated funding won’t be received by your organization for years or even decades. Other times, a planned gift offers real-time benefits, both to your organization and to the donor.

Types of planned gifts by category

While there are many types of planned gifts, they can be grouped into two main categories: deferred donation and immediate donation.

Deferred donations are received at some point in the future, typically after the donor has passed away. Immediate donations are transferred to your organization upon commitment of the gift, giving you immediate resources to fund your mission and programs. However, immediate donation planned gifts often require ongoing management, including regular payments back to the donor.

Deferred donation planned gifts

Deferred donation planned gifts are committed within a donor’s lifetime, but will not be received by the organization until after the donor’s death. There are two primary types of deferred donation planned gifts:

Charitable bequests and estate gifts

Charitable bequests are the most common and accessible types of planned giving. With a bequest, a donor names your organization in their will or trust, making you a beneficiary of their estate.

Donors may dedicate a specific dollar amount or percentage of their estate to your organization, or they may request that the remaining value of the estate be given to your organization after all other obligations have been met. Some bequests also come with strings attached, ensuring that a gift is only made if certain conditions are met.

Bequests offer a number of benefits. As a portion of the donor’s total estate, the value of a bequest planned gift is often higher than gifts that a donor is willing or able to make in their lifetime. There is no upfront cost, and, as one of the simplest planned gift options, they’re easy to explain and promote with prospective donors.

Clear communication of the bequest language is key to understanding the type of planned gift that has been made and the obligations your organization may have. Plus, your organization must be able to effectively track and steward bequest donors—often called legacy donors—throughout the life of their planned gift, whether that’s two years or twenty.

Retirement plans and life insurance

Many people do not utilize the full extent of their retirement savings or life insurance when they die. That leaves a number of funds remaining for other purposes, including an inheritance to the individual’s family or a charitable contribution.

Many donors will commit a portion of their retirement savings or life insurance to an organization. These funds are distributed after the donor’s final expenses are paid, and have the potential to be quite large, depending on the total value and lifetime needs of the donor.

Immediate donation planned gifts

Immediate donation planned gifts allow donors to make a charitable contribution during their lifetime. However, unlike traditional cash donations, these types of planned gifts allow the donor to receive income from the gift.

Immediate donation planned gifts include:

- Charitable gift annuities

- Charitable remainder trusts & unitrusts

- Pooled income funds

- Charitable lead trusts

- Retained life estates

Charitable gift annuities

With Charitable gift annuities, a donor makes a gift directly to your organization in exchange for fixed payments for life. After the donor’s death, the remainder of the gift goes to your organization to support your mission.

These gifts not only put valuable funds in the hands of your organization right now, but also help to protect your donor’s financial future. In addition to ongoing payments, charitable gift annuities allow donors to receive tax credit for the gift during their lifetime.

Charitable remainder trusts and unitrusts

To establish a charitable remainder trust, a donor places financial assets in a trust. The trust pays income to them (or others) based on a percentage of the total for a set period of time. That time period may be defined as a certain number of years or the lifetime of the donor. At the end of the period, the remaining balance is paid out to your organization.

Like charitable gift annuities, these types of planned giving allow the donor to receive immediate tax credit for their donation while also receiving income from the value of the trust. Charitable remainder trusts also allow donors to avoid capital gain and estate taxes on the funds.

Charitable remainder unitrusts are similar to charitable remainder trusts, but allow for additional flexibility. Charitable remainder unitrusts can be funded with a wide range of assets, from cash to real estate to stock. Rather than paying the donor a fixed amount over the lifetime of the trust terms, the donor received a percentage of the fair market value of the trust assets. This number is reevaluated and adjusted annually.

Pooled income funds

Pooled income funds combine donations from a number of donors, then invest those collective funds. Each donor receives a portion of income from the investment aligning with their share of the total pool, based on their original contribution amount. While the funds are invested, organizations typically cannot directly access the funds until a donor has passed away, protecting them for future use.

Charitable lead trust

A Charitable lead trust puts your organization first, paying a fixed income to your organization for a set period of time. After that time, the remaining assets are returned to the donor distributed to their heirs. CLTs are often used in estate planning for wealth transfer, as they help to reduce the burden of estate taxes.

Retained life estate

For donors in possession of valuable property assets, a retained life estate transfers property ownership while allowing the donor to enjoy the property for the remainder of their life. The donor receives tax credits for their donation during their lifetime, and your organization retains full right of ownership upon the donor’s death.

Best practices for receiving, managing, and stewarding every type of planned gifts

Planned gifts offer many benefits to both organizations and to the donors that fund them. However, these decisions should not be made lightly. Before making a planned gift, donors should consult with their tax, finance, and legal advisors.

Likewise, organizations should thoughtfully consider the type and terms of these gifts before accepting them—especially immediate donation planned gifts. Immediate donation planned gifts are typically more complex than bequests and often involve legal agreements, actuarial calculations, and investment planning that require expert guidance, whether within your organization or with the help of outside advisors.

Empower donors and strengthen missions through planned giving

Planned giving presents a meaningful way for donors to leave a lasting legacy while providing vital support to the missions they care about. From deferred options like charitable bequests and estate gifts to immediate contributions such as charitable annuities and remainder trusts, these gifts come in many forms, each offering unique benefits to both donors and organizations. By understanding the types of planned gifts and their potential impact, nonprofits can better position themselves to nurture these long-term donor relationships.

Now is the time to start meaningful conversations with your supporters about planned giving. By opening the door to these opportunities, you create pathways for donors to make a profound and lasting impact. What steps will your organization take today to inspire and encourage your community of donors?

For an in-depth look at planned giving, take a look at our Planned Giving 101 ebook.

Be the first to read our resources.

The world is changing quickly—and our resources help you stay on top of it all. Sign up to get new insights, success stories, and more, sent right to your inbox.